Financial Forecast 2019: Can Cannabis Save the Beer Industry?

No one on Wall Street knows the burgeoning cannabis industry better than Vivien Azer, the managing director for consumer beverages, cannabis and tobacco at investment house Cowan and Company.

She often asks beer company CEOs about legal cannabis taking market share away from the most popular alcoholic beverage in America in states where pot is legal. Routinely, the executives dismiss any challenge from marijuana with the argument that people already get as much cannabis as they want on the black market, so any switch over to legal weed isn’t going to dent beer sales.

During a January 8 conference call, Azer said 2018 was the “worst year for beer sales in the near decade we’ve been covering the alcohol industry and we continue to believe that growing cannabis use is a factor.”

It’s all about re-engagement, a big trend for the current year and beyond. It goes like this: Once cannabis is legal, more people who may have dabbled with it in college or whenever will return to the green herb and hence drink less beer.

Cowen and Company Reports Decline in Beer Sales

Cowen’s latest consumer survey shows that people who used pot in the past month climbed to 39% at the start of 2019 compared to 30% in September 2016. It also indicates that a large portion of consumers across all alcohol types report either already drinking less beer (60%) or anticipating to do so (70%).

This and other data prompted Azer to hike her U.S. cannabis sales forecast by $5 billion to $80 billion by 2030, up from her earlier estimate of $75 billion. It’s one of many enthusiastic outlooks for the current year as the legal cannabis business continues its quick growth as a mainstream product.

Cowen and Company’s Vivien Azer

With recreational and/or medical markets coming online in Massachusetts, Ohio, Maine, North Dakota, Florida and possibly New York and New Jersey, Azer expects more substitution in place of all types of alcohol. “We’re increasingly cautious on beer,” she added.

The analyst ranks Canadian cannabis producers Canopy Growth Corp. (NYSE: CGC) and Tilray Inc. (NASDAQ: TLRY) and U.S. container maker KushCo Holdings Inc. (OTC: KSHB) as strong buys, but is much less bullish about Anheuser Busch Inbev and Molson Coors Brewing Co.

“For Canopy and Tilray, we should finally start to see the true benefits of adult-use sales, and the lapping of upfront investments made in calendar 2018 to scale up ahead of adult use,” Azer noted. “For Kush, we expect a fifth consecutive year of triple-digit growth as the company benefits from continued strong growth in California and Nevada, in addition to the new market opportunity in Massachusetts.”

Beer Makers Are Fighting Back with Canna Beverages

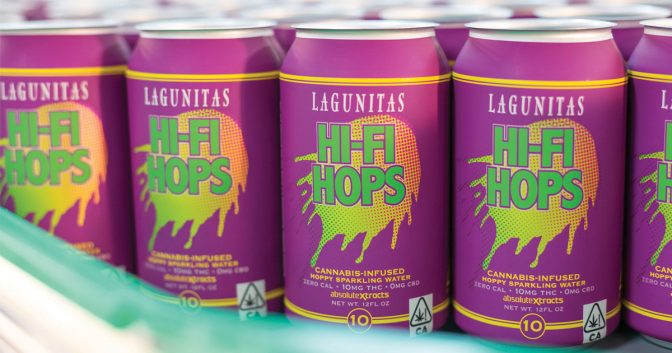

A rash of new joint ventures announced last year between big brewers and cannabis companies should make 2019 the year of the canna-beverage. Heineken’s Lagunitas and AbsoluteXTracts have already teamed up in California to create their non-alcohol canna-IPA Hi-Fi Hops.

Similar products are expected from Molson and Hexo Corp. (OTC: HYYDF), Constellation Brands Inc. (NYSE: STZ) and Canopy Growth, and Anheuser-Busch and Tilray. All three Canadian companies made deals with alcohol conglomerates in 2018. The largest was Constellation Brand’s $4 billion buy-in to Canopy Growth. Another hot 2018 rumor was Coca-Cola negotiating with Aurora Cannabis (NYCE: ACB), but that seemed to fizzle.

Asked if she thinks other Big Alcohol players like spirits maker Diageo will enter the cannabis space, Azar remarked tersely, “I’d expect all the large global alcohol companies are paying attention.”

Thanks to passage of the U.S. Farm Bill, hemp and CBD products will keep ascending in wellness, beauty and food categories. Major retailers like CVS and Walgreen’s recently announced they will begin stocking their shelves with CBD creams and tinctures. Cowen & Co. projects the category could become a $1.6 billion business over the next few years.

Watch Out for Big Pharma and Tobacco

Outside of food, beverages and cosmetics, cannabis will keep impacting other industries like pharma and tobacco. This year may see some action from Altria Group Inc. on its $1.8 billion stake in Canadian producer Cronos Group Inc. (NASDAQ: CRON) that the maker of Marlboro cigarettes announced last year. Another tobacco manufacturer, Alliance One International, should see its 80% stake in the Goldleaf Pharm grow facility in Canada start to bear fruit.

Congressional legislation like the STATES Act would remove marijuana from the Controlled Substances Act, essentially legalizing it, while other bills deal with nagging issues like banking and tax equity.

Matt Karnes of GreenWave Advisors predicts $12.7 billion in overall retail sales in 2019—up from about $9.3 billion in 2018—and says prepare to see more mergers in Canada and the U.S. “The bar will be raised in terms of talent pool as employees from more mainstream companies enter the sector,” he tells Freedom Leaf.

VIVIEN AZAR: “There are institutional investors that won’t touch cannabis, even in areas where it’s legal. But there are some that have gotten comfortable with investing in compliant cannabis businesses.”

Joe Lusardi, CEO of Curaleaf (OTC: CURLF), the Massachusetts-based dispensary operator, thinks 2019 “is going to be the biggest year ever for legalization” because of the boost from Massachusetts and Michigan, in addition to activity underway in other states. Curaleaf currently operates 34 retail outlets, including one in Belmawr, NJ, which the company hypes as the biggest pot purveyor on the East Coast. They’re hoping to double the number of stores and expand to 10 states by the end of 2019.

Brad Nattrass, CEO of Colorado-based Urban-Gro, an agricultural technology firm, thinks large corporations will invest millions in cannabis cultivation operations, but reminds in an email that “many cultivations in 2018 were not as profitable as was projected. There’s cautiousness in the market now with some growers and investors waiting to see how the market shakes out before pursuing new opportunities.”

To be sure, plenty of obstacles remain. California’s cannabis business has yet to fully transition from the black-market economy. Profit margins may shrink in agricultural production because of competition, forcing operators to build for scale to compete.

Institutional Investors Remain Cautious About Cannabis

Capital is also a constraint because of the Schedule I classification of marijuana under federal law. This keeps banks, for the most part, from raising capital from investors and lending.

While solutions to some of these challenges may be years away, they persist in shaping the new cannabis landscape. At the same time, the more immediate focus is on fueling growth and deal-making at an accelerated pace.

“Last year was the year of the large multi-state operator for investors,” says Beth Stavola, president of operations at MPX Bioceutical Corp. (OTC: MPXEF), an Ontario-based company known for its Melting Point Extracts brand. “With more big industries entering the space, it will be interesting to see which operators will find homes in the beverage, pharma and tobacco industries or be acquired.”

Canna-stocks will remain volatile until the sector trades more on its fundamentals, like revenue and net income, and less on speculation about future growth. Many big institutional investors that have capital to spend may stay away, at least until federal law prohibiting marijuana changes.

“I do know there are institutional investors that, until they feel better about U.S. status, won’t touch cannabis, even in areas where it’s legal,” Azer asserts. “But there are some that have gotten comfortable with investing in compliant cannabis businesses.”

Despite these and other headwinds, expect optimism to pervade in cannabis in 2019.

Related Financial Articles

The Cannabis Industry’s Top 20 Pot Stocks

Tilray Makes Deals with Novartis and Anheuser-Busch

Altria Group Makes Major Move into Canadian Cannabis Market

This article appears in Issue 35. Subscribe to the magazine here.